ANÁLISIS | STREAMING PLATFORMS | PAY TV

Oppenheimer

Of the four big legacy conglomerates, NBCUniversal looks like the second most stable and viable long term — behind Disney and well ahead of Warner Bros. Discovery and Paramount Global.

This year’s Paris Summer Olympics will offer an opportunity for the platform to distinguish itself as a premier SVOD with the right combination of live sports and scripted series.

Universal is looking to build on its industry-leading 2023 box office and awards performance spearheaded by Christopher Nolan’s Oppenheimer. In an example of modern-day entertainment synergy at its finest, those popular Universal films have helped Peacock push its on platform demand share up to 8.8% in Q1 2024, a noticeable uptick from 7.6% a year ago. Peacock has now finished ahead of Paramount+ for two consecutive quarters in this category.

Peacock has bled money over the last four years, but the Comcast C-suite insists its losses peaked in 2023. The platform built momentum in Q1 2024, led by the first ever streaming exclusive NFL Playoff game. Most importantly, Peacock is retaining most of the new subscribers who joined to watch the Kansas City Chiefs beat the Miami Dolphins.

That said, the longterm viability of Peacock as a standalone streamer remains questionable. Even after steady growth, Peacock is stuck in last place among the major streamers in demand for its streaming original series. While it is making progress in total on-platform demand share, it still ranks just sixth in the category.

This year’s Paris Summer Olympics will offer an opportunity for the platform to distinguish itself as a premier SVOD with the right combination of live sports and scripted series. But if the streamer doesn’t start significantly cutting its quarterly losses, Comcast’s patience may wear thin.

NBCU was first criticized for not investing enough into its direct-to-consumer business and then seemingly lauded for its careful consideration after Wall Street soured on the streaming model. While the overall entertainment company is well positioned, its streaming future remains in an uncertain no man’s land. As such, it has the power to shake up the industry hierarchy should it decide to go all in on streaming or exit the field entirely. INFORMATION AND DATA from Parrot Analytics.

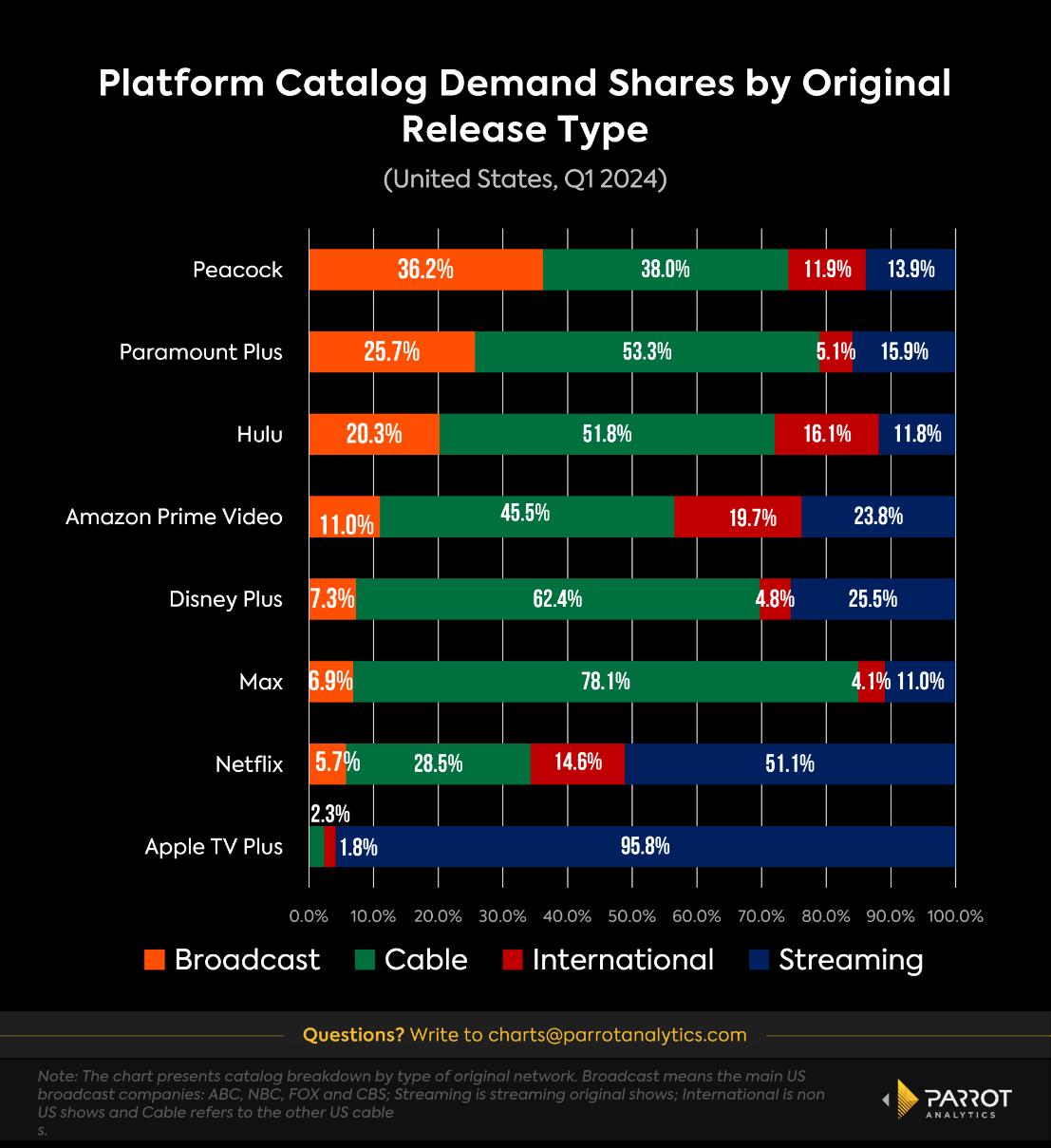

Catalog Demand Share by Original Release Type

- Streaming original content only accounts for a fraction of the overall demand for most streamers, showing why many legacy companies are now re-opening up their libraries to licensing deals after trying to build up walled gardens earlier this decade.

- Peacock has successfully leveraged its strong line up of linear programming — including next-day NBC content, and of course Bravo’s popular reality franchises such as The Real Housewives.

- Expect NBCUniversal to aim for the right combination of exclusive content on Peacock, while also increasing revenue streams by licensing out highly in-demand library content.

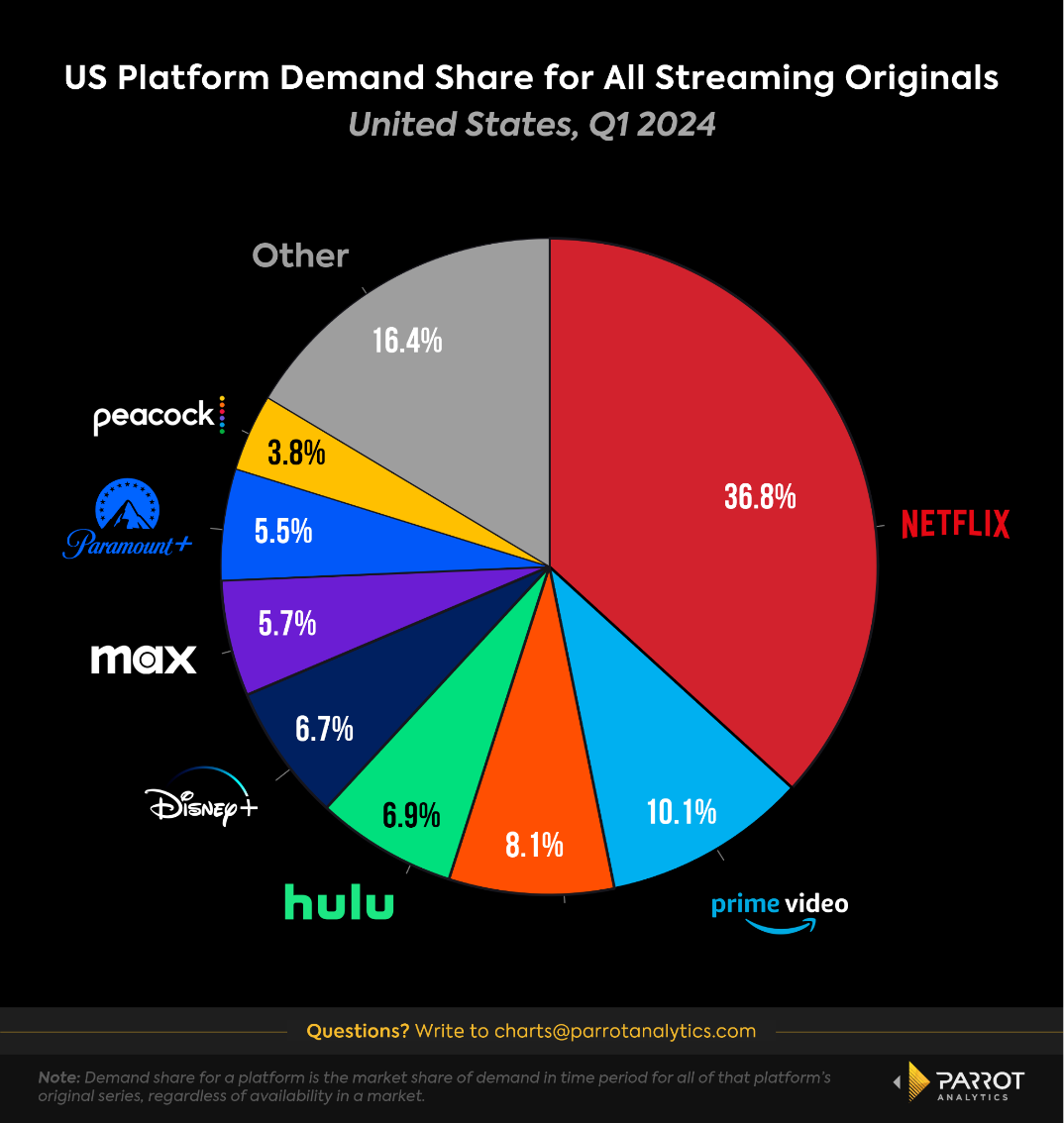

Streaming Original Demand Share

- One major opportunity for improvement for Peacock remains its demand for streaming originals. The platform is still in 8th place in originals.

- Peacock’s originals demand share steadily grew from 0.9% in Q4 2020 to 3.9% in Q3 2023 with US audiences. For the last two quarters, Peacock has hit 3.8%, showing that originals growing has plateaued.

- Original content is highly expensive to produce, but successful originals directly drive subscriber acquisition. Comcast must decide if it wants Peacock to be a contender in streaming originals, or focus on live sports and exclusive content from its linear channels.

Redacción TVMAS